RTO Form 36: Application for Issue of a Fresh Certificate of Registration in the Name of the Financier

Sometimes, auto owners purchase vehicles under hire-purchase or lease or hypothecation agreements but eventually fail to pay off their loans. In such a scenario, Financiers take possession of automobiles and apply for the issuing of a fresh Registration Certificate (RC) by filling up RTO Form 36. It helps to establish them as the new owner of the vehicle. This RTO application is unique because here, the applicant is the Financier instead of the original Registered Owner of the motor.

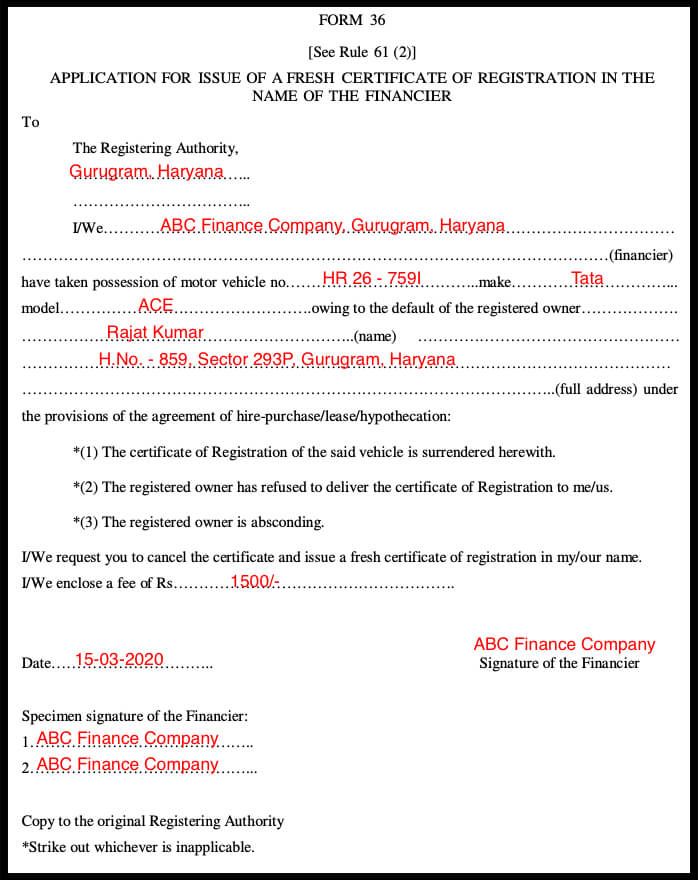

How to fill RTO Form 36 Application?

Unlike other RTO applications, Form 36 consists of only a single section where the Financier requests for the issuing of a fresh Certificate of Registration in their name. Detailed below is a step by step process of filling up RTO Form 36.

- Start filling up the application by mentioning the name of the RTO under whose jurisdiction you wish to register the vehicle.

- In the next space, the Financier should mention their name as mentioned in the hire-purchase or lease or hypothecation agreement.

- Now, enter the vehicle registration number, and its make and model. Check the original Registration Certificate to fill up these details.

- In the next space, write the name and complete postal address of the original Registered Owner, as mentioned in the RC and the agreement.

- In the following spaces, the Financier declares whether they are enclosing the original Certificate of Registration or the owner has refused to surrender the same, or the owner is absconding. The applicant has to strike out whichever clause is inapplicable.

- Finally, the Financier requests the RTO to cancel the previous RC and issue a fresh Certificate with the name of the Financing Company.

- The applicant also makes the payment for a fresh Registration and mention the amount on the Form.

- In the concluding part of the application, the Financier affixes his signature and date of submission of the document.

Documents to be Attached

- Original Certificate of Registration

- Hire-purchase or lease or hypothecation agreement between the original Registered Owner and the Financier

- Identity and address proof of the Registered Owner

- Receipt of the payment of fees for Form 36 submission

Download Application for Issue of a Fresh Certificate of Registration in the Name of the Financier

Download NowKey Factors to be considered while filling Form 36

- Enter the vehicle number, make, and model of the confiscated automobile like Tata ACE carefully.

- Write the name and address of the original owner, as mentioned in the hire-purchase or lease or hypothecation agreement.

- Check the website for the correct amount of fees for Form 36 submission.

Conclusion

Finally, we can say that RTO Form 36 is unique than all other RTO documents, as here the Financier is the applicant instead of the automobile owner. If the original Registered Owner purchases a vehicle on hire-purchase or lease or hypothecation agreement with a Financing Company and then defaults on the loan, then RTO Form 36 helps in transferring the automobile to the Financier’s name. The Registering Authority issues a fresh RC with the Financier as the new owner of the motor after the processing of the document.